Md Property Tax

Property Tax - Marylandtaxes.gov

Maryland's 23 counties, Baltimore City and 155 incorporated cities issue property tax bills during July and August each year. The tax levies are based on property assessments determined by the Maryland Department of Assessments and Taxation (SDAT). Since the Comptroller's Office does not process property tax, we have provided the following links to Maryland property tax information:

https://www.marylandtaxes.gov/individual/property/index.php

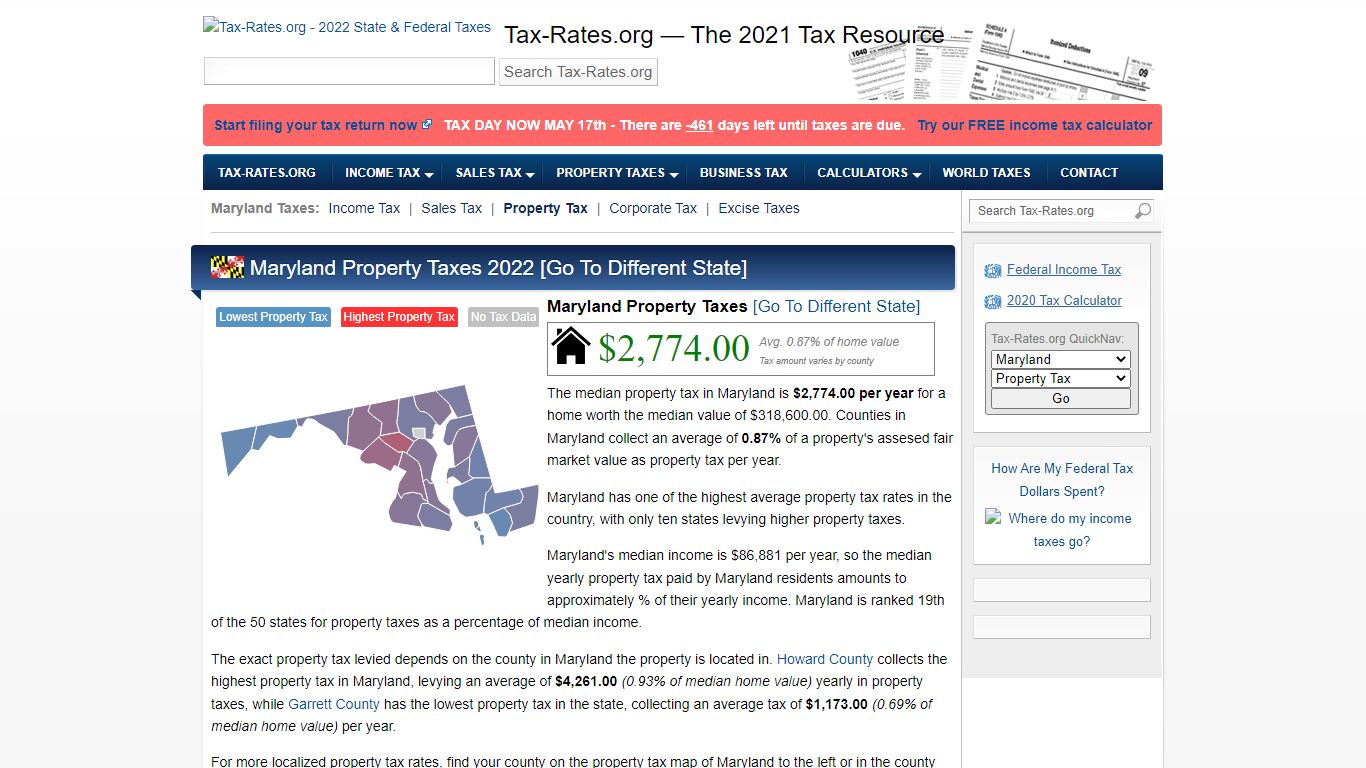

Maryland Property Taxes By County - 2022 - Tax-Rates.org

Maryland's median income is $86,881 per year, so the median yearly property tax paid by Maryland residents amounts to approximately % of their yearly income. Maryland is ranked 19th of the 50 states for property taxes as a percentage of median income. The exact property tax levied depends on the county in Maryland the property is located in. Howard County collects the highest property tax in Maryland, levying an average of (0.93% of median home value) yearly in property taxes, while Garrett ...

https://www.tax-rates.org/maryland/property-tax

Real Property - Maryland Department of Assessments and Taxation

Assessments are certified by the Department to local governments where they are converted into property tax bills by applying the appropriate property tax rates. An assessment is based on an appraisal of the fair market value of the property. An appraisal is an estimate of value. There are three accepted approaches to market value:

https://dat.maryland.gov/realproperty/Pages/default.aspx

Marylandtaxes.gov | Welcome to the Office of the Comptroller

Comptroller of Maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Marylandtaxes.gov RELIEF Act Contact Us 1-800 MDTAXES Email Us Governor's Office Translate Marylandtaxes.gov Home COVID COVID-19 Agency Response Workgroup on Pandemic Spending Carryout, Delivery & Outdoor Seating During COVID-19 File

https://www.marylandtaxes.gov/

Business Personal Property Taxes - Marylandtaxes.gov

Business Personal Property Taxes. In Maryland there is a tax on business owned personal property which is imposed and collected by the local governments. Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation. Personal property generally includes furniture, fixtures, ...

https://www.marylandtaxes.gov/business/business-personal-property/index.php

Property Taxes | Prince George's County, MD

The Maryland Department of Assessments and Taxation makes tax credits available to qualified individuals. Contact that office for information about the Homeowner's Tax Credit, Homestead Tax Credit, 100% Disabled Veteran Exemption or Blind Exemption. The telephone number is 301-952-2500 or online. Charges You may have 1 or more charges on your tax bill:

https://www.princegeorgescountymd.gov/426/Property-Taxes

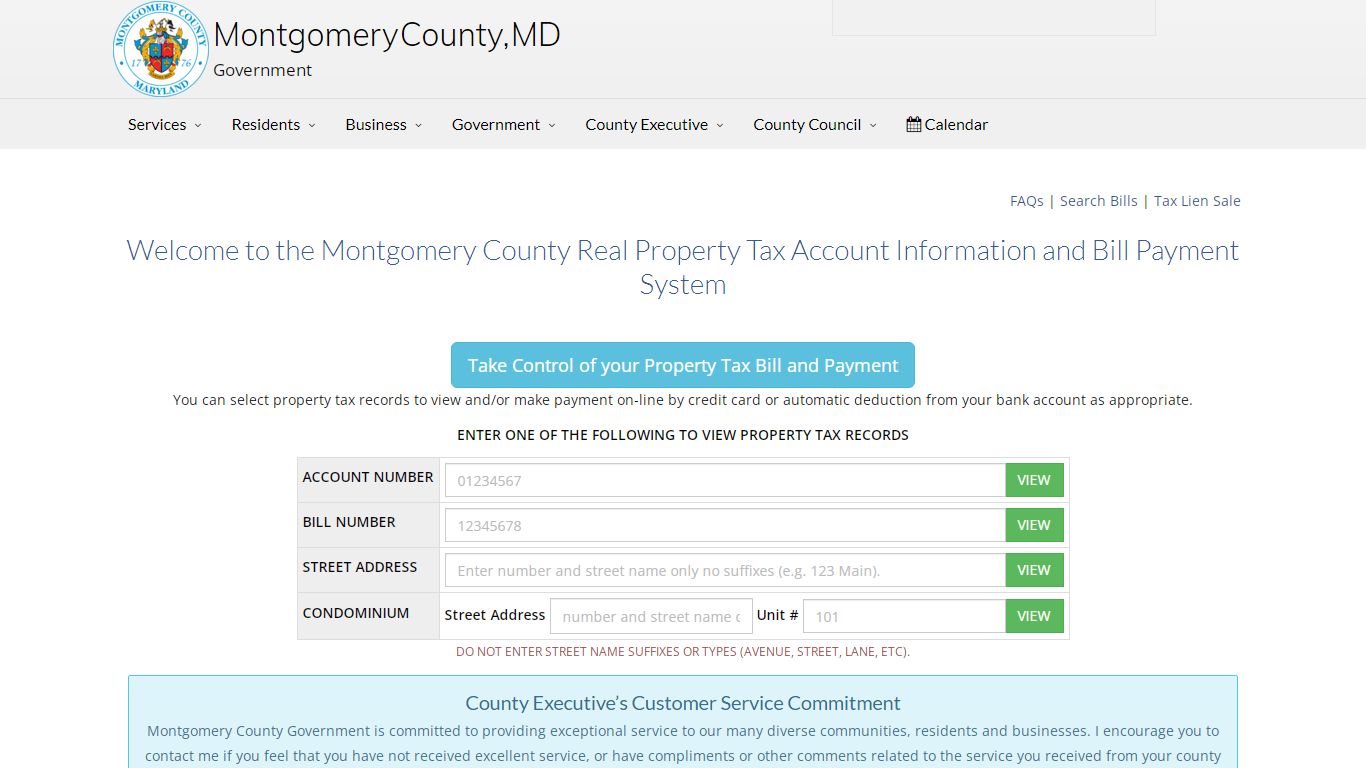

Montgomery County Maryland Real Property Tax - Online Check Payment

Take Control of your Property Tax Bill and Payment. You can select property tax records to view and/or make payment on-line by credit card or automatic deduction from your bank account as appropriate. ENTER ONE OF THE FOLLOWING TO VIEW PROPERTY TAX RECORDS. ACCOUNT NUMBER.

https://apps.montgomerycountymd.gov/realpropertytax/

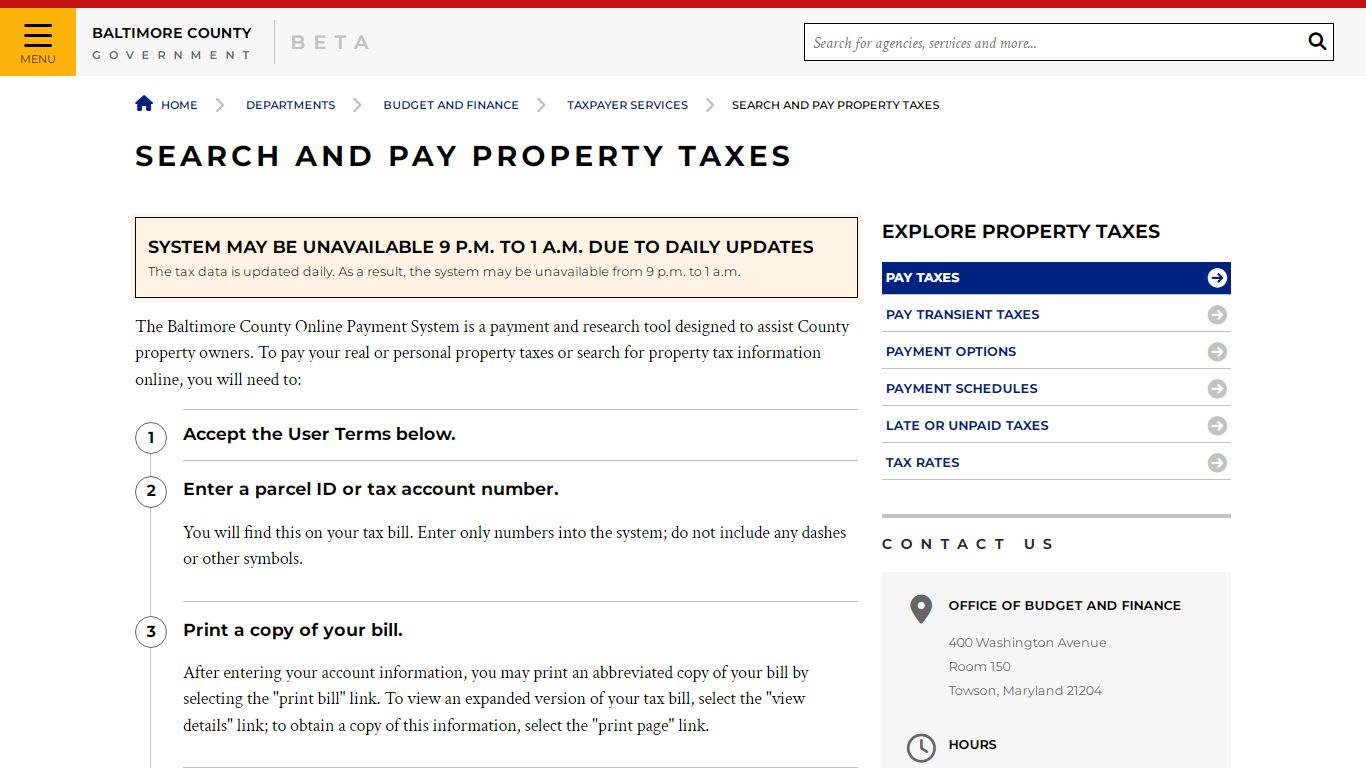

Search and Pay Property Taxes - Baltimore County, Maryland

Explore Property Taxes Pay Taxes Pay Transient Taxes Payment Options Payment Schedules Late or Unpaid Taxes Tax Rates Contact Us Office of Budget and Finance 400 Washington Avenue Room 150 Towson, Maryland 21204 Hours Monday through Friday 8 a.m. to 4:30 p.m. Email [email protected] Phone 410-887-2404 Fax 410-887-3882 Director

https://www.baltimorecountymd.gov/departments/budfin/taxpayerservices/taxsearch.html

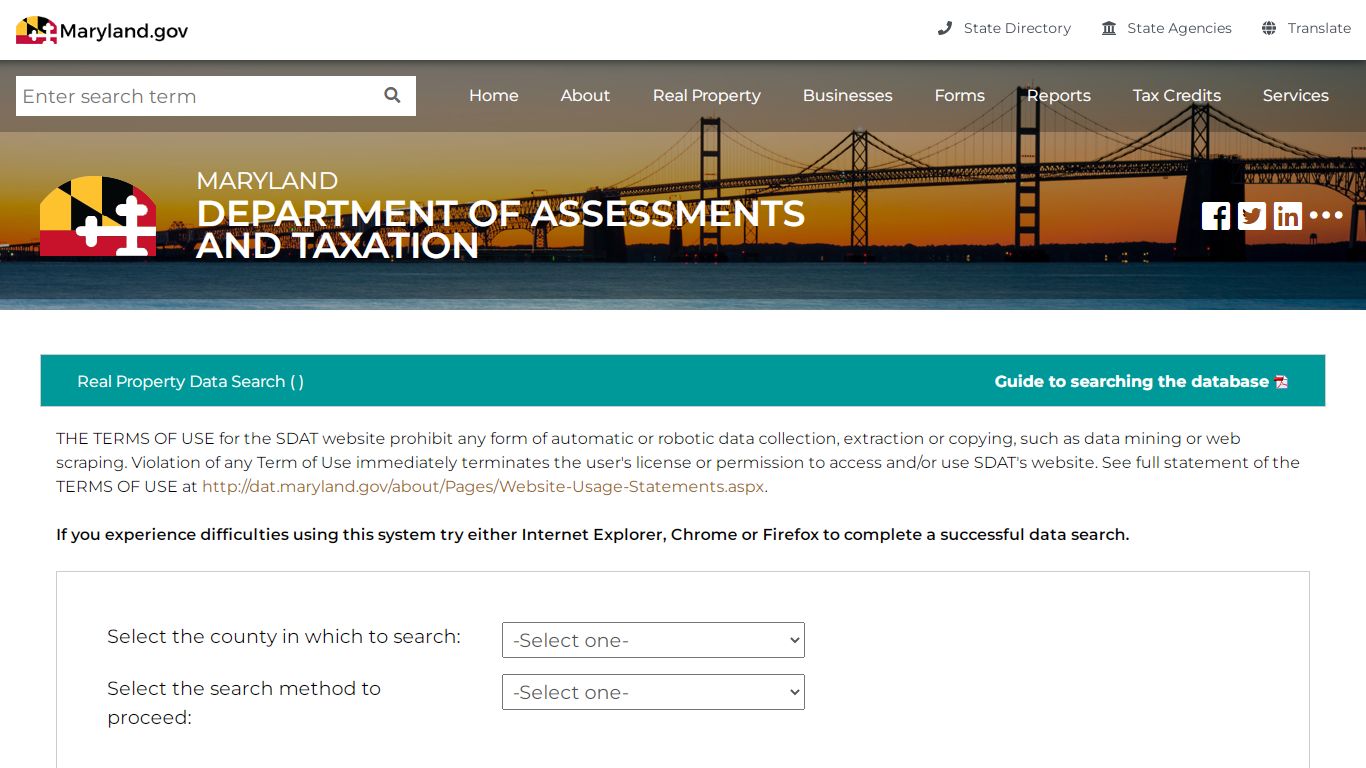

SDAT: Real Property Data Search< - Maryland Department of Assessments ...

This screen allows you to search the Real Property database and display property records. Click here for a glossary of terms. Deleted accounts can only be selected by Property Account Identifier. The following pages are for information purpose only. The data is not to be used for legal reports or documents.

https://sdat.dat.maryland.gov/RealProperty/Pages/default.aspx

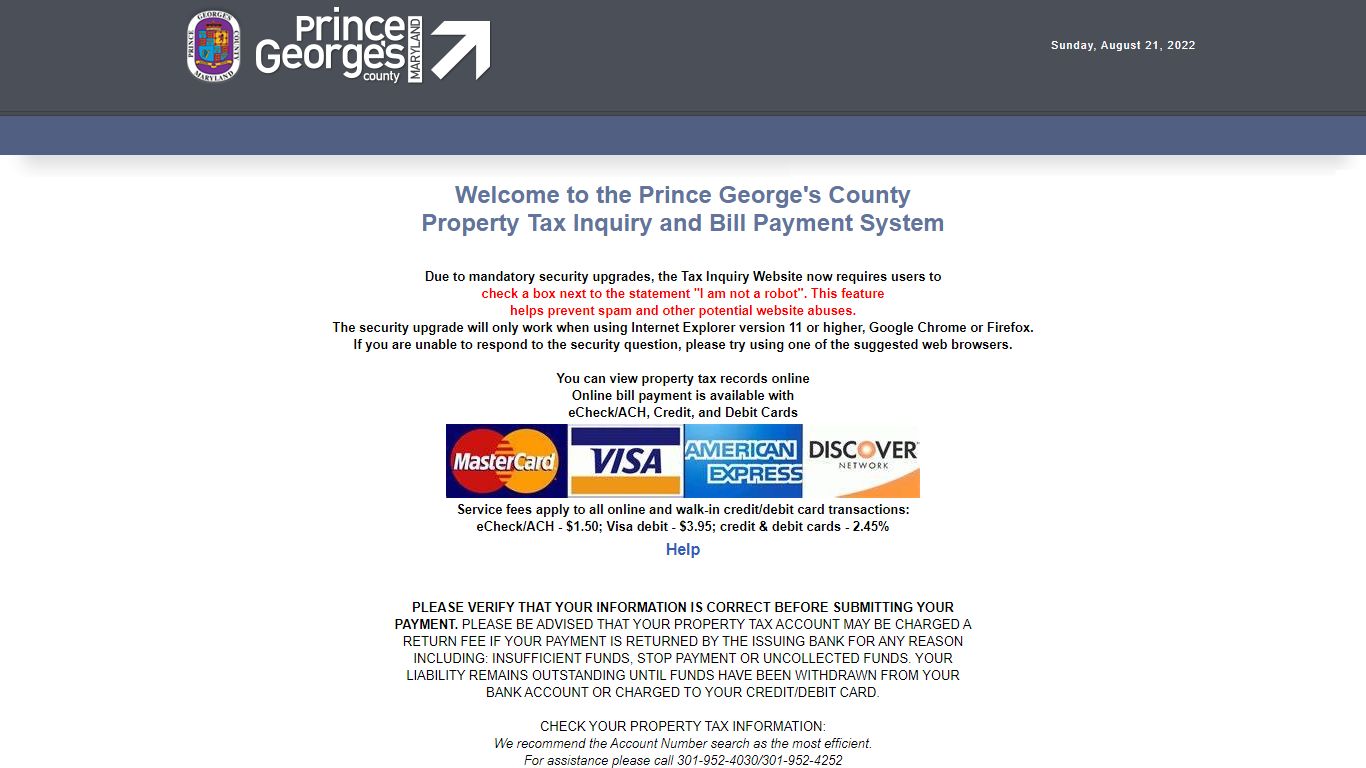

Prince George's County, MD - Office of Finance : Property Tax Inquiry

CHECK YOUR PROPERTY TAX INFORMATION: We recommend the Account Number search as the most efficient. For assistance please call 301-952-4030/301-952-4252 Please enter your seven-digit account number OR your street address in the boxes below. Click GO to access your account information. 0123456 (7 digits) (No District)

http://taxinquiry.princegeorgescountymd.gov/

News and Announcements - Maryland Department of Assessments and Taxation

While SDAT strongly encourages filers to submit the Annual Report online through Maryland Business Express, Annual Reports and Business Personal Property Returns may be hand delivered to the drop boxes located in the lobby of 301 West Preston Street between 8:30 AM and 4:30 PM, Monday. through Friday.

https://dat.maryland.gov/Pages/default.aspx